Example Letter Explaining Business Loss. In major cases, these letters are sent when the business faces financial troubles in ways of input or output of production. A sorry letter is a good way to mend back any broken relationship if a proper explanation is given.

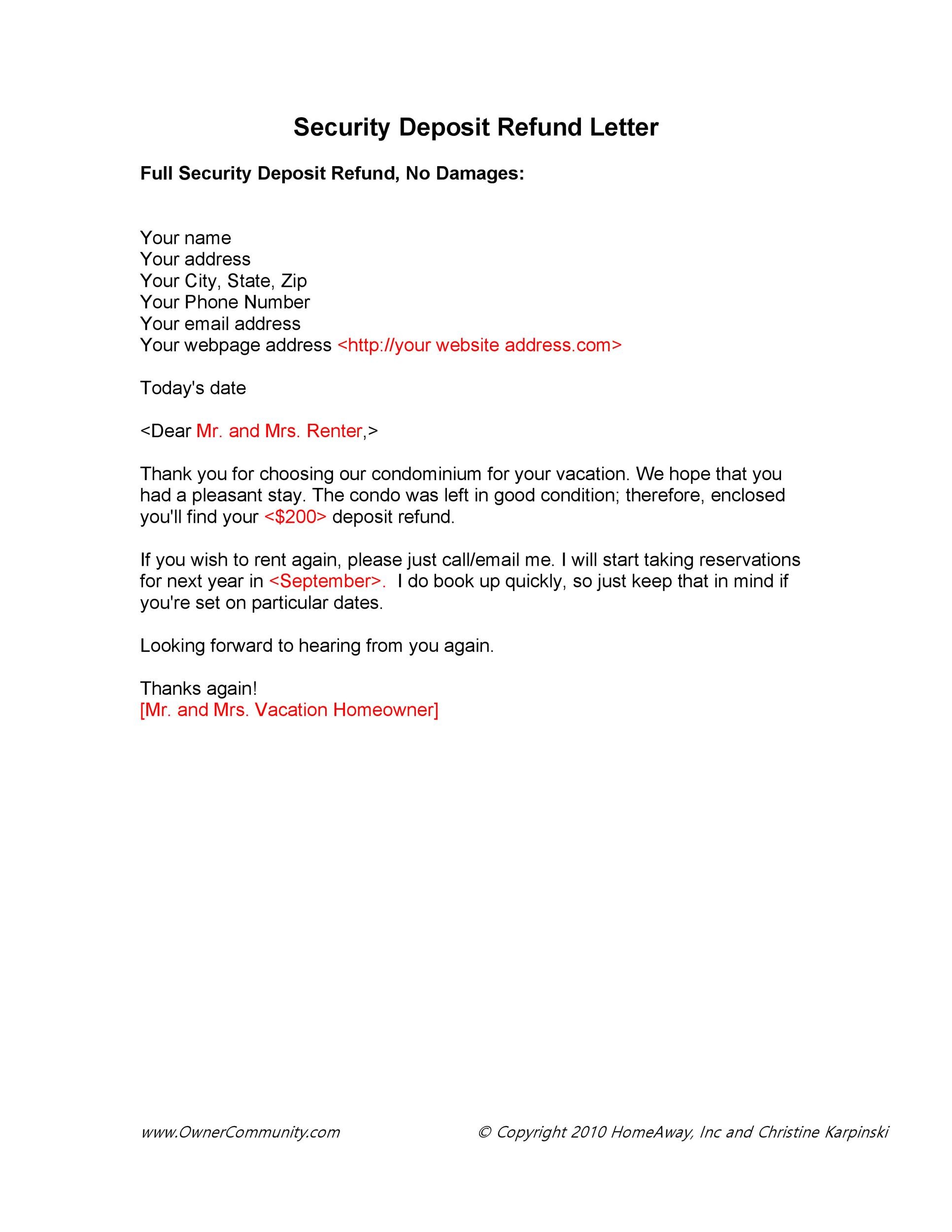

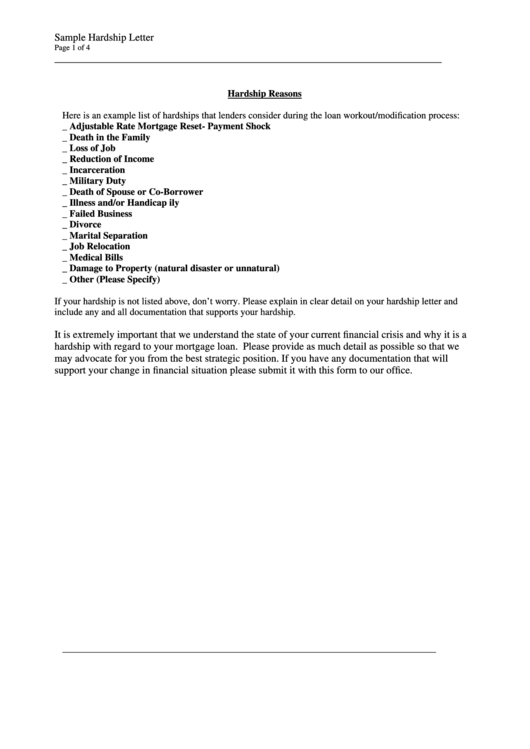

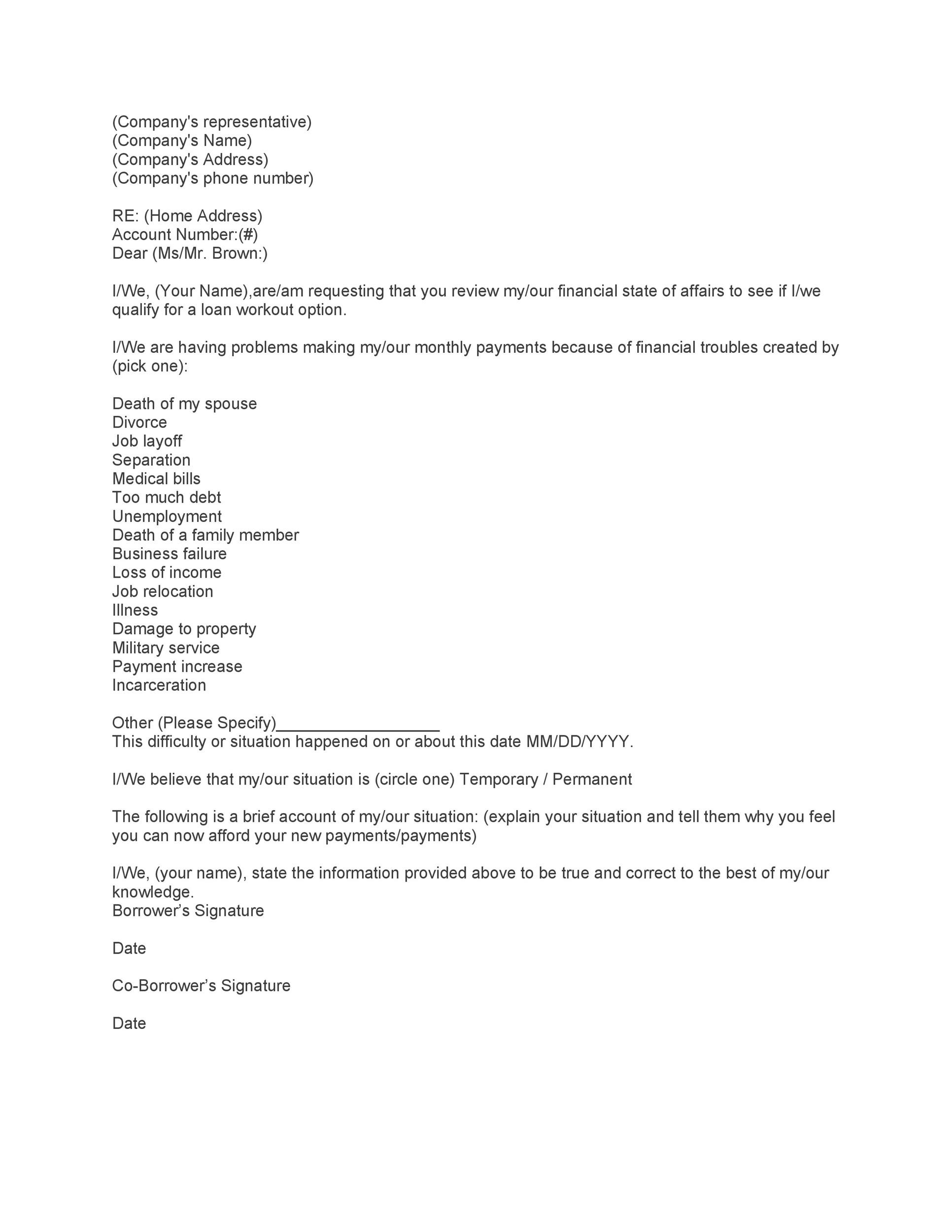

When you're writing a letter of explanation for a mortgage, customize the content to your circumstances.

Although business owners start companies with the intention of generating a profit that helps them increase their wealth, many companies do not generate a profit in their initial years.

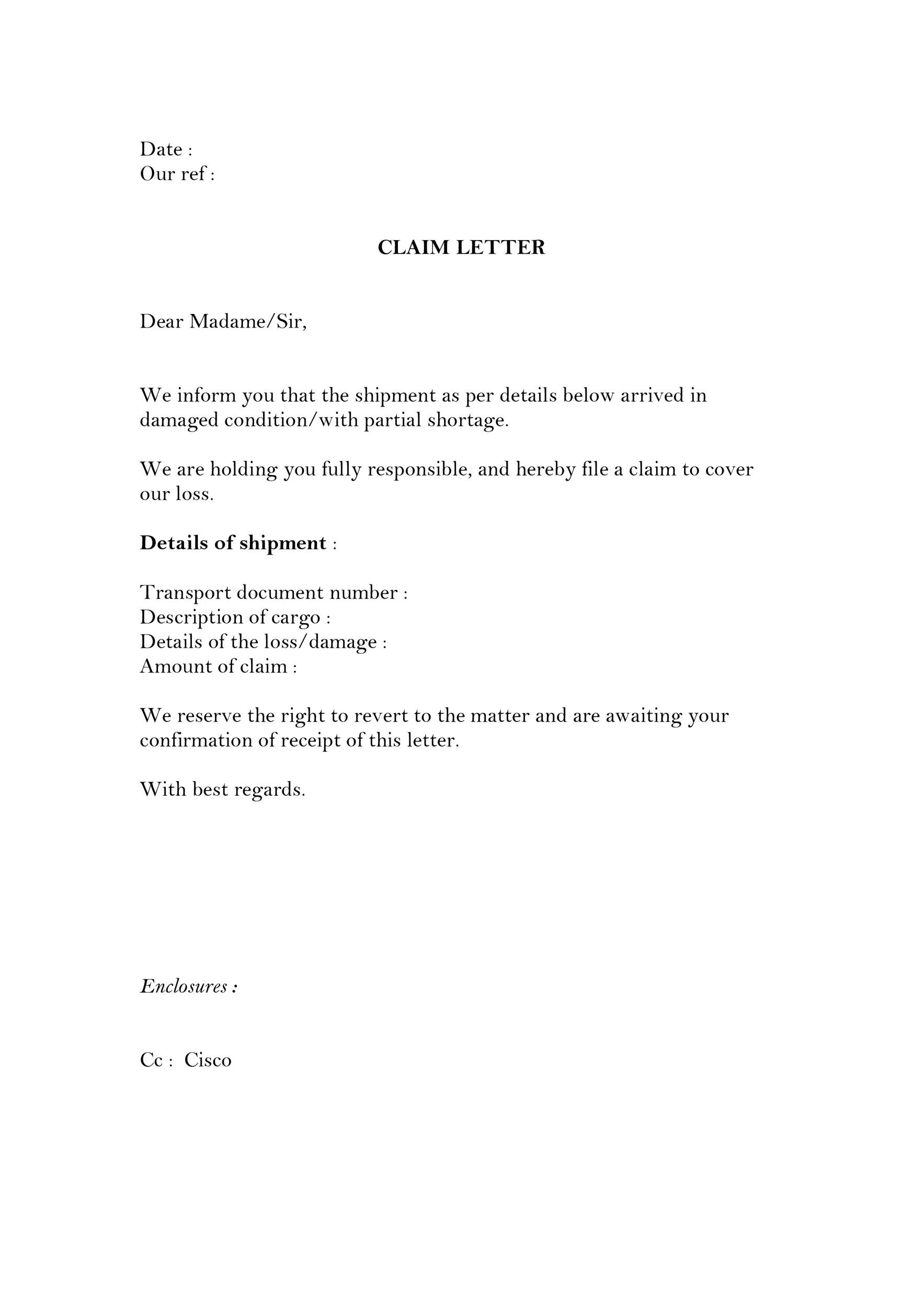

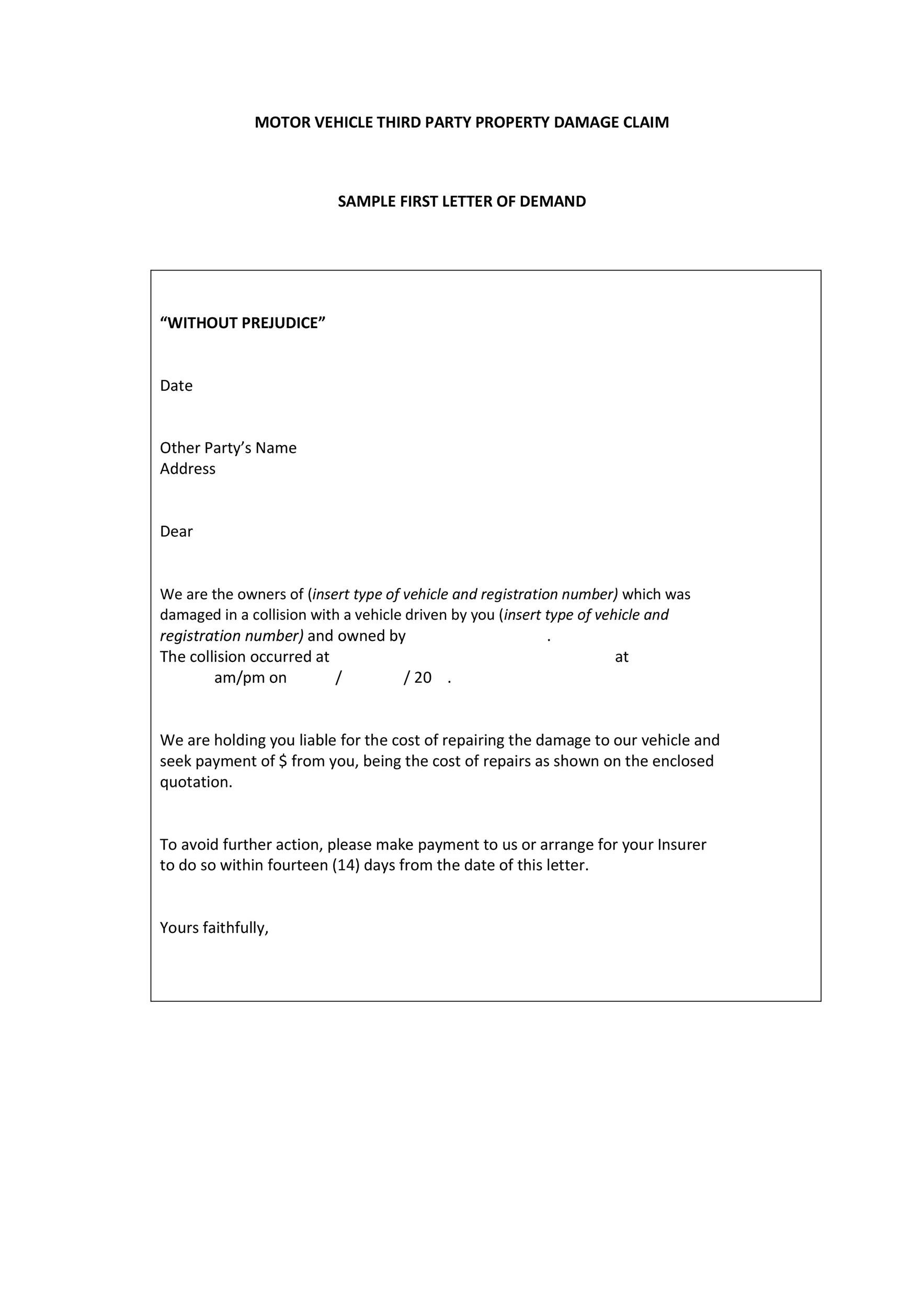

Below is a sample bankruptcy explanation letter, and it's designed only to be a basic template. Reader question: "We have been asked to write a letter of explanation for our mortgage lender's underwriter, regarding a bank overdraft fee. Simply worded, it's a letter of complaint which demands a request for an adjustment in the form of a refund or a replacement or payment for damages. copy of your Schedule C, Profit or Loss from Business, from your federal income tax return for the tax year noted on your letter: any license, registration, or certification that you need for your business: Examples include credentials for taxicab drivers, cosmetologists, and health- and food-service workers.